Mortgage Rates Experience a Slight Decline on March 9, 2025

March 10, 2025 - 04:57

Mortgage rates have seen a small decrease today, March 9, 2025, with the average rate for a 30-year fixed mortgage now standing at 6.31%. This reduction in rates is a welcome relief for prospective homebuyers and those looking to refinance their existing loans.

The dip in mortgage rates can significantly influence monthly payments, making homeownership more accessible for many. For example, a lower interest rate can reduce the total interest paid over the life of the loan, resulting in substantial savings for borrowers.

As the housing market continues to evolve, potential buyers are encouraged to take advantage of these favorable rates while they last. With economic factors constantly shifting, it remains crucial for individuals to stay informed about the latest trends in mortgage rates. This slight decline could represent an opportunity for both first-time buyers and seasoned homeowners looking to secure better financing options.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

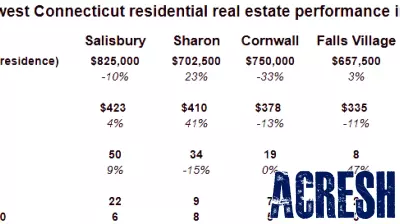

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...