Navigating Capital Gains: A Doctor's Journey to Financial Independence Through Real Estate

October 20, 2025 - 05:05

Savvy real estate investors are increasingly leveraging 1031 exchanges as a strategic method to defer capital gains taxes when selling investment properties. One such investor is a full-time doctor who has successfully utilized this approach to build her financial independence while managing a demanding career in medicine.

By reinvesting the proceeds from the sale of one property into another, she can defer paying taxes on the profits, allowing her to grow her real estate portfolio more rapidly. This strategy not only helps her avoid immediate tax liabilities but also provides her with the opportunity to enhance her investment returns over time.

In addition to tax benefits, the doctor has found that real estate investment offers a degree of stability and passive income that complements her medical practice. As she continues to scale her portfolio, her journey serves as an inspiring example for others looking to achieve financial freedom through smart real estate investing.

MORE NEWS

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

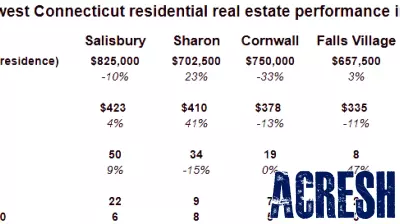

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...

January 7, 2026 - 11:27

Cawley Partners Expands Portfolio with Harwood No. 1 AcquisitionIn a significant move within the real estate sector, Cawley Partners has successfully acquired the Harwood No. 1 property. This strategic acquisition is expected to enhance the firm`s portfolio and...